6 Types Of stocks everyone should know about. Learn about different types of stocks. Tips for better investing.

Table of Contents

Introduction

Whether you are a beginner or professional when it comes to investing, choosing the right type of stocks to invest in is very important. Trading different assets has never been easier, ranging from equities and cryptocurrencies to commodities and foreign exchange. Investors of all stripes may now enjoy the thrill and possible profits of trading from the comfort of their homes or while on the go, thanks to internet trading platforms. It’s imperative that you conduct thorough study before investing in stocks because this is one decision that cannot be compromised. We have put together a list of the kinds of stocks that every investor needs to be aware of in order to assist you with that.

Common Stocks

Common stock, also known as ordinary shares, denotes a company’s partial ownership. This form of stock entitles holders to produced earnings, which are typically distributed as dividends. Shareholders of common stock have theoretically limitless upside potential, but they also run the risk of losing everything if the business fails with no assets left over.

The simplest form of stock, it grants shareholders the ability to vote and frequently dividend payments.

Preferred stocks

A specific dividend is paid to shareholders of preferred stock, which also gets dividend priority over common stock. Preferred stock isn’t always preferred by investors, despite its name.

Because preferred stock often pays higher fixed-income payments than bonds with smaller investment per share, it is appealing. In addition, preferred stockholders are entitled to dividend payments and liquidation proceeds before holders of common stock. Compared to ordinary stock, its price is typically more steady.

Preferred shareholders are entitled to dividend distributions ahead of common shareholders. Overall, this leads to preferred stock having more in common with fixed-income bond investments than standard common stock as an investment.

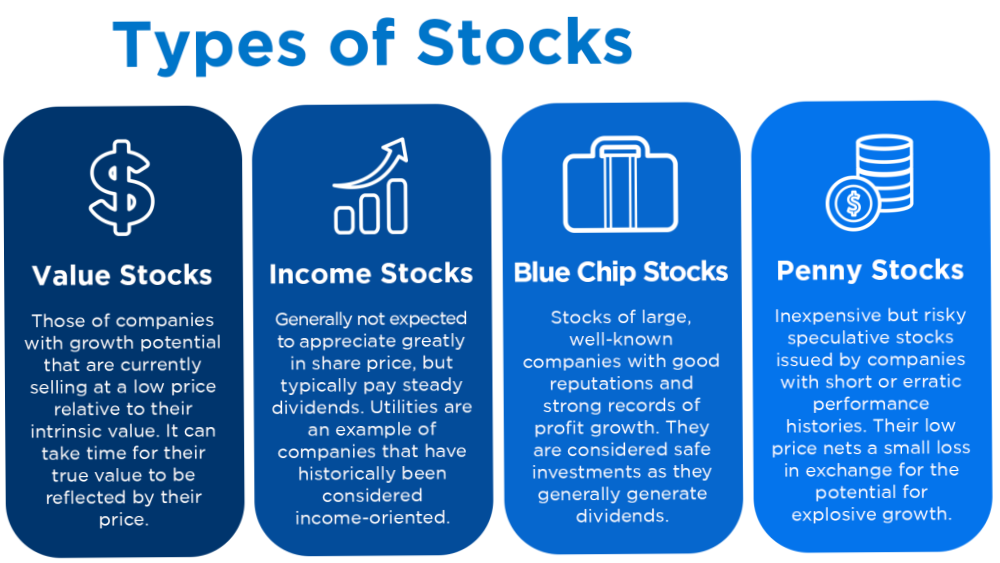

Income Stock

Income stocks are investments that have a low risk profile and provide consistent, predictable income over time—typically in the form of dividends. Because they generate income for shareholders, typically through relatively significant dividend distributions, income stocks are referred to as such. Shares of businesses with more established business strategies and substantially less long-term growth potential are referred to as income stocks. The majority of the total gains on an investment may come from the high yield that income stocks often give. These stocks pay out dividends that are higher than the industry average in order to distribute a company’s profits, or excess cash, on a regular basis. When compared to other equity instruments, income stocks carry a significantly lower risk. Income stocks are less affected by market changes than other stocks. As a result, in this instance, the price appreciation factor is rather little.

Large-cap Stocks

Large-cap stocks are those belonging to companies with the highest market capitalizations. In this context, “cap” stands for market capitalization, specifically the market capitalization of the underlying corporation for a particular stock. A market valuation of more than $10 billion characterizes a large-cap corporation. A small-cap firm has a market valuation of less than $2 billion, whereas a mid-cap corporation has a market capitalization of between $2 billion and $10 billion. Compared to mid-cap organizations, large-cap corporations—those with market capitalizations of US$10 billion and above—generally expand more slowly. Comparing large-cap funds to mid- and small-cap funds, the former are thought to be safer. Microsoft (MSFT), Apple (AAPL), ExxonMobil (XOM), Walmart (WMT), and other well-known corporations are some instances of large-cap stocks.

Mid-cap Stocks

Companies with a market capitalization of $2 billion to $10 billion are referred to as mid-cap stocks, and they are regarded as a well-rounded investing choice. These equities yield a larger return than large-cap stocks and have less risk than small-cap companies. Due to their ability to act more quickly than large caps and their greater financial stability compared to small caps, mid-caps are able to generate higher returns, giving them a competitive advantage in the pursuit of growth. When making an investment in mid-cap firms, investors want to take the caliber of revenue growth into account.

When it comes to their investing characteristics, mid-cap stocks are generally less volatile, riskier, and may have less room for development than small-cap stocks; on the other hand, large-cap stocks are more volatile, riskier, and offer greater opportunity for gain.

Small-cap stocks

A publicly traded company’s shares that have a market valuation of between $250 million and $2 billion are known as small-cap stocks. Investing in small caps on its own is riskier than investing in large caps. Small-cap stocks are particularly vulnerable to market swings, which means that they are more likely to be impacted during periods of market distress, such recessions, and require more time to recover from. Investing in tiny caps carries a higher risk due to such market activity. But if one goes the mutual fund way, the risks are lower because fund managers often monitor liquidity, track the company, broaden the portfolio, and assess it.

5 Tips For Choosing The Right Stocks To Invest In

Selecting the best stock to buy is a crucial choice that needs careful thought and investigation. Here are some tips to help you choose the best stocks to invest in for better results:

- Clearly state your goals for your investments, whether they be dividend income, capital growth, or both. Your objectives will determine the kind of stocks you ought to look into.

- Determine the level of danger you are ready to accept. Although they have a greater chance of providing large profits, high-growth equities are also more volatile. Blue-chip stocks and other lower-risk investments may offer stability but may not have as much room for development.

- Examine the businesses that pique your interest. Examine their annual reports, financial statements, and current events. Keep an eye on their management group, market developments, and competitive edge.

- If you’re interested in growth, you might screen for factors such as historical or projected growth rates. If you care more about value, you might screen for low price-to-book or price-to-earnings ratios.

- After you’ve narrowed down your list to the most promising options, examine the trend line of each stock. Generally speaking, it’s a good idea to enter a trade when you can either purchase into an uptrend or, if the decrease seems unusual, when you can buy into a dip.

Conclusion

To create a diverse and well-rounded portfolio, investors must first understand the different kinds of equities. as there are a variety of possibilities available in the stock market, such as defensive and cyclical stocks, value and dividend stocks, small-, mid-, and large-cap companies, and so on. Your investment strategy, risk tolerance, and financial goals should all be taken into consideration while selecting stocks. It’s critical to approach stock investing thoughtfully, thoroughly investigate the market, and have a clear idea of your own financial goals.

by watchnewz

Frequently Asked Questions

What do stocks caps mean?

Knowing what market capitalization is. The whole value of a company’s stock is referred to as its market cap, often known as its capitalization. You may compare the relative sizes of companies by using their market capitalization. DST Enterprises, Inc.

Does market cap rationale or not?

A decent market cap for investors depends on their investing objectives. Smaller market capitalization have greater potential for growth, but large market caps usually indicate stability. To counteract any drops in the value of a particular market cap category, investors usually construct stock portfolios with a variety of market caps.

Is High EPS better?

One commonly used statistic for determining corporate value is earnings per share (EPS), which shows how much money a firm produces for each share of its stock. Because investors would pay more for a company’s shares if they believe it has larger earnings relative to its share price, a higher EPS is indicative of greater value.